Not just funding a partner in your journey

Seed investment

Growth & Beyond IPO

Growth financing

Having our investor support talent acquisition was a true advantage—reducing costs when resources mattered most, and connecting us with candidates we could genuinely trust. No HR firm could offer this level of alignment and reliability.

In the highly regulated and specialized healthcare industry, FuturePlay’s deep understanding of Huinno’s culture helped us find talents who truly fit — not only in skill, but in spirit. We look forward to continuing this strong partnership for Huinno’s sustainable growth.

Hiring great talent is never easy for a startup. From finding the right people and starting conversations, to convincing them and finally becoming one team — having FuturePlay as an investor walking with us through every step has been truly reassuring.

It may seem unusual for an investor to support hiring, but FuturePlay’s deep understanding of the startup ecosystem and its extensive network made the process more professional and systematic than any HR solution we’ve experienced. We believe this is a service every startup could truly benefit from.

FuturePlay creates investment and growth in a completely new way, together with founders

Behind every number, there was always a founder

![[리얼퓨처] 인재의 시애틀👨💻 로봇의 보스턴🤖 자본의 뉴욕💸 : ep. 13-2](https://i.ytimg.com/vi/bDWDKzEMscw/maxresdefault.jpg)

채널: FuturePlay 퓨처플레이

셀바티코 제공 프랑스 헤리티지 기반 프래그런스 브랜드 셀바티코가 4일부터 12일까지 더현대 서울에서 개최되는 '리딩 파티(Reading Party)'에 참여해 고객들에게 향기를 읽는 경험을 선사한..

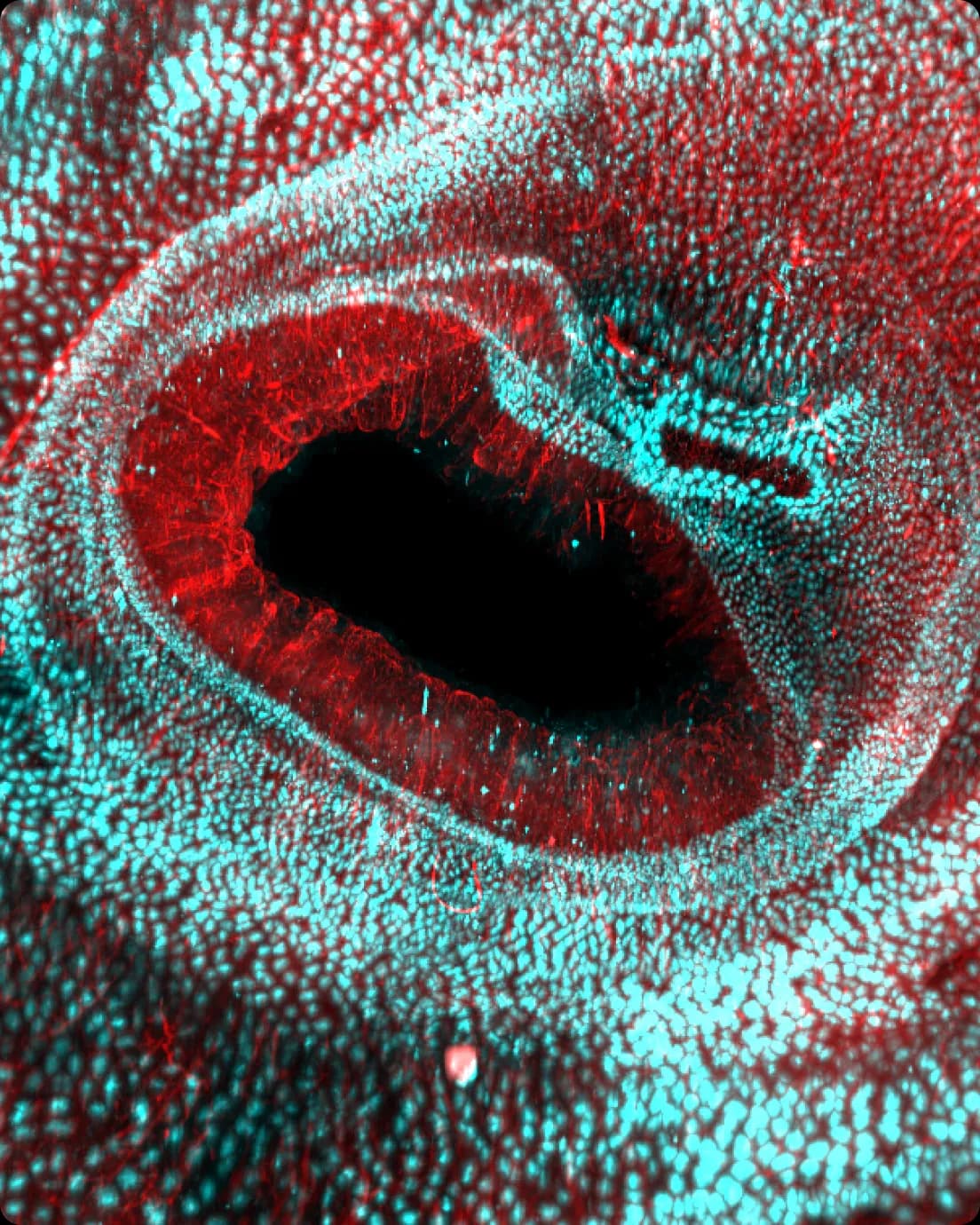

AI 기반 3차원 머신비전 스타트업 클레가 160억 원 시리즈A 투자를 유치했다. 3D 카메라와 시각 정보 분석 AI로 자동차, 반도체, 국방 등 다양한 산업 자동화와 해외 시장 진출을 확대한다.

퓨처플레이, PE 라이선스 취득…기업 단계별 투자 강화 액셀러레이터(AC)와 벤처캐피탈(VC) 자격을 보유한 퓨처플레이가 '기관 전용 사모집합투자기구 업무집행사원'(PE) 라이선스를 취득했다고 3일 밝혔다.이번 자격 …

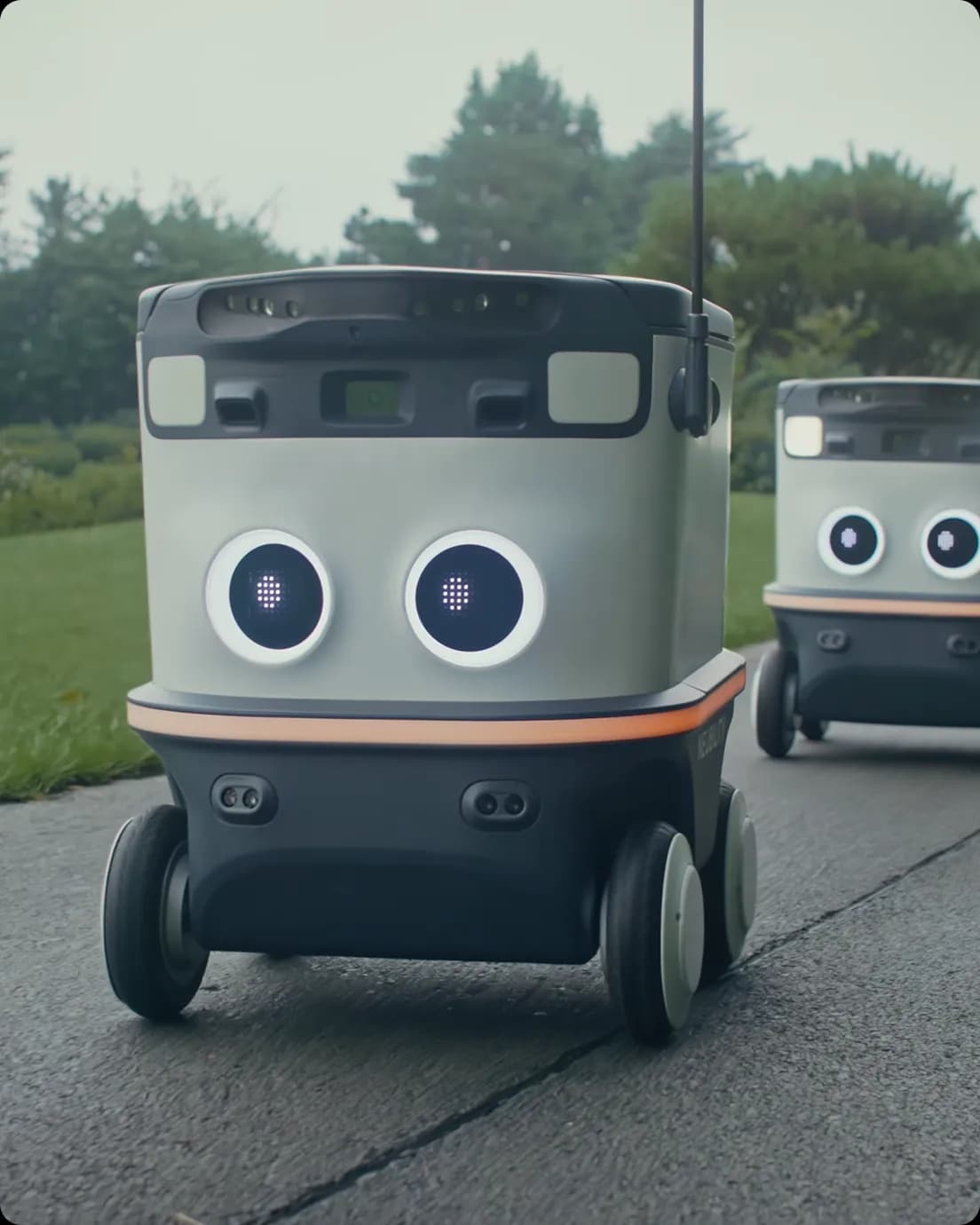

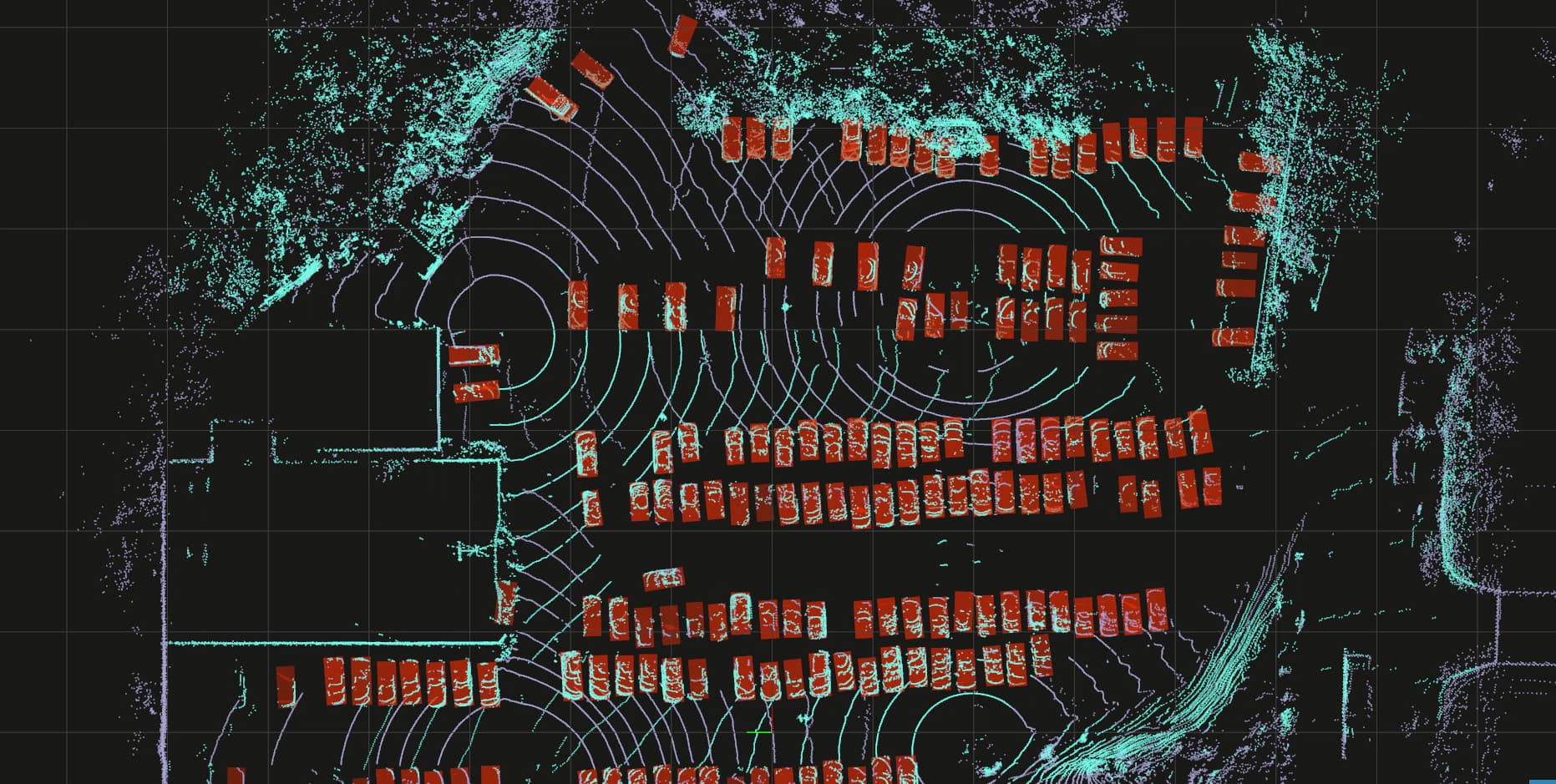

서울로보틱스가 일본 글로벌 완성차 기업 닛산그룹 공장 내 인공지능(AI) 기반 물류 자동화 프로젝트를 수주한 것이 일본 언론의 집중 조명을 받았다. 29일 서울로보틱스에 따르면 일본 최대 경제지인 니혼게이자이신문(닛케이)을 비롯해 도쿄신문, 교도통신 산업 관련 뉴스

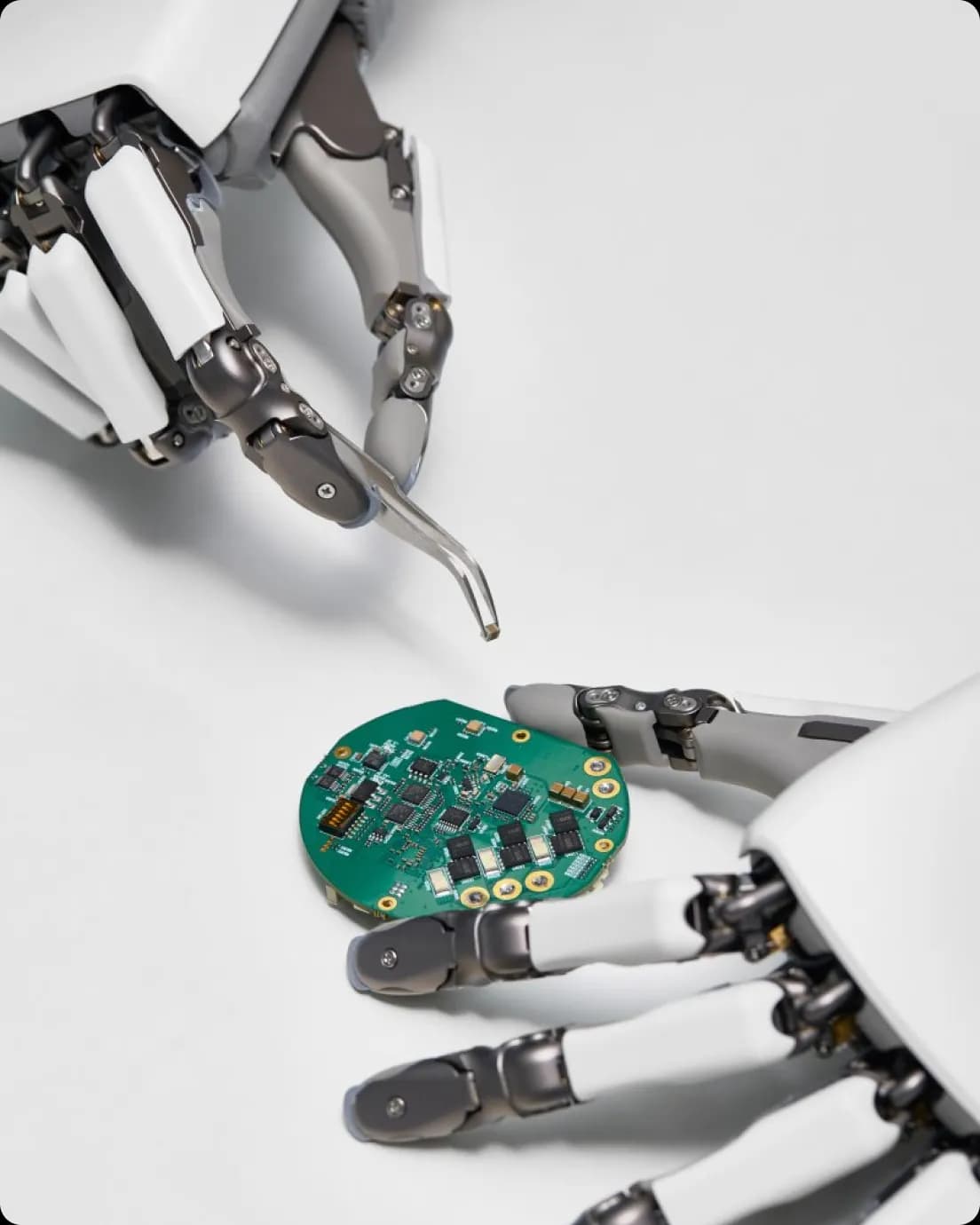

As the global industrial robot market rapidly expands in the wake of the advances in artificial intelligence (AI) technologies, manufacturers are i...

X-Sentry, a startup developing sensor solutions for small modular reactors (SMRs), has secured seed investments from a number of accelerators, incl...